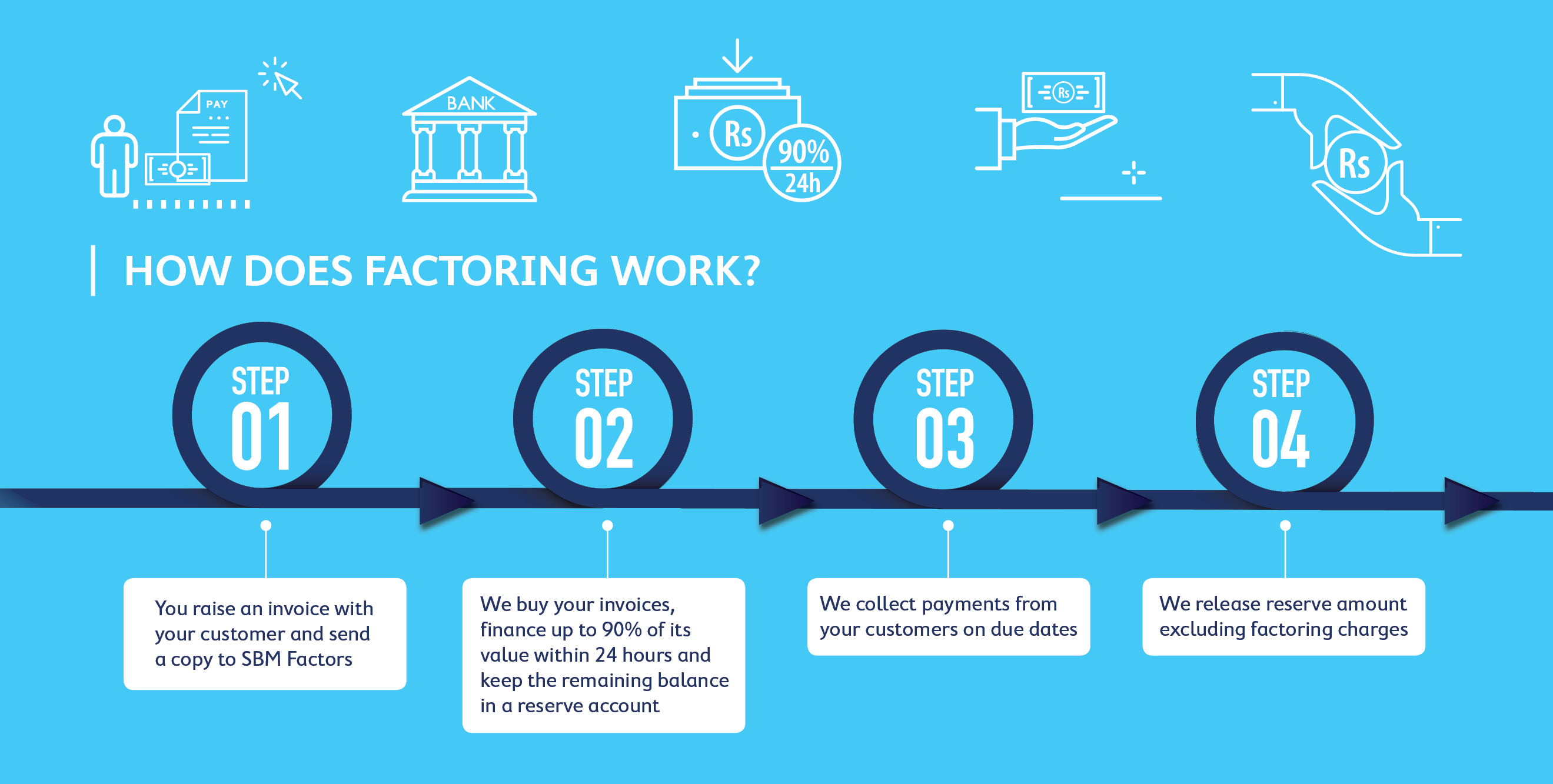

How does Factoring work?

Step 1: You send your invoices to SBM Factors

Step 2: We buy your invoices and pay you up to 90% of its value within 24 hours and keep remaining balance in reserve account

Step 3: SBM Factors collects payments from your customers on due dates

Step 4: SBM Factors releases reserve amount less factoring charges

- Up to 90% of the invoice value paid in your bank account within 24 hours

- Debt free- Factoring is not a loan and therefore keeps your balance sheet clean

- Credit screening for new debtors by SBM Factors which will enable you take better business decisions

- Our credit control team will collect the payments on your behalf, allowing you spend more time developing and growing your business. You will have complete visibility through regular reporting and meetings with us

- Debtor protection against potential bad debts through the credit insurance cover

- No need to provide additional collaterals

- Experienced team of professionals at your service

- Relationship driven approach to customer management which enable us to know and understand your business ongoing funding requirements

- A factoring fee based on the following:

- your average credit sales turnover

- your type of clients

- Interest rate on funds advanced

- Credit insurance to cover your debts

The above fees are quickly absorbed by all the benefits you will reap from our factoring services