Want to invest your hard-earned Rupees to generate stable returns while enduring little risk?

SBM Perpetual Fund aims at maximising long-term returns whilst managing overall risks. We invest your capital in a diversified portfolio of local fixed income securities (Government securities, corporate debt, term deposits, and Cash and Cash equivalents) to ensure that your earnings see systematic growth.

Your financial future depends on your current decisions. It should be well-planned with a proper assessment of your goals and risks tolerance.

Diversified portfolio

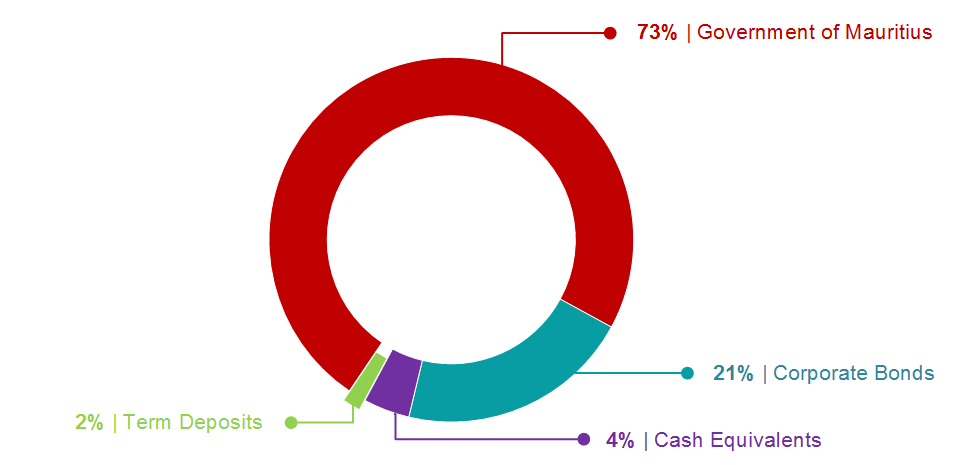

100% fixed income strategy using a combination of Government of Mauritius securities, corporate bonds and term deposits.

Low volatility

The strategy of SBM Perpetual Fund is to invest in a diversified portfolio of fixed income securities issued by domestic issuers.

It does not invest in the stock market or in foreign markets. There is neither market risk from equities nor foreign exchange rate risk from FX exposure.

Liquidity

Investors can subscribe to and redeem the units of the Fund on a fortnightly basis. This allows flexibility in case of liquidity needs of investors. Investors can also pledge their investments in SBM Perpetual Fund for loans.

Capital growth

Long-term capital appreciation opportunity for investors seeking a relatively low-risk investment.

Assuming that an investor had invested at the Fund’s inception, they would have more than doubled their investments (116.9%) over the last 15.3 years (as of January 2022).

Why invest now?

Time is money and one of the best ways to reach one’s investment objective is by investing over a long-time period. Over the long-term, an investor can gain from compounding whereby they can earn more from reinvestment of interests/dividends.

If an individual had invested a one-time MUR 100,000 in SBM Perpetual Fund over 15 years, his or her funds would have grown to MUR 216,885. In comparison, over a 5-year period, the initial investment would have only been MUR 121,587 and MUR 103,416 over a 1-year period.

Who can invest?

Individual and institutional/corporate investors.

Accessible to both residents and non-residents of Mauritius.

Investors under the age of 18 must have a guardian to act on their behalf.

What is the minimum Investment amount?

A minimum of MUR 100,000.

Does the Fund pay dividends?

The objective of SBM Perpetual Fund is long-term capital appreciation and does not pay any dividend. Gains are reflected in the Net Asset Value (NAV) of the Fund.

Does the Fund have a term?

The Fund does not have any term and investors can remain in the Fund as long as they wish to. The longer they remain invested in the Fund, the larger will be their expected capital growth.

Can investors cash their investments any time?

The Fund accepts subscriptions and redemptions on the 15th and every last business day of the month. An investor can cash the investments on a fortnightly basis but will do so at a repurchase price. The repurchase price will include an exit fee of 1.0% if holding period is less than 1 year, 0.75% if less than 2 years and 0.50% if less than 3 years. Over 3 years, there is no applicable exit fee.

How many days after redemption will investors receive their monies?

According to the Prospectus of the Fund, investors shall be paid the redemption price within 30 days of the applicable dealing day.

Does SBM Group own the Fund?

The Fund is a Collective Investment Scheme and is mutually owned by the investors. SBM Mauritius Asset Managers Ltd only provides investment management services to the Fund.

Is the Fund Capital Guaranteed?

The terminology “capital guarantee” either does not apply in Finance or is subject to events. The Fund has one of the lowest risk profiles on the domestic market as it invests only in fixed income securities and mainly in Government of Mauritius instruments. The Investment Manager has put in place measures to manage risks.

Can investors pledge against a loan?

Yes – the loan amount will depend on the lending bank’s policy and the applicable loan-to-value.

Can investors transfer their securities?

This is subject to the conditions of the Prospectus.

Required documents

Corporates:

- Certified true copy of certificate of incorporation

- Certified true copies of business registration card

- List of directors, certified true copies of their ID and of proof of residential address ( e.g. utility bill or bank statement)

- List of authorised signatories

- Board resolution approving investment in the Fund

Individuals:

- Proof of identity - National ID Card/Passport

- Proof of residential address (e.g. utility bill or bank statement)

Risk factors

The NAV per unit of the Fund may go up or down depending on market conditions. Prices of bonds and fixed income securities fluctuate, which means that the value of the Fund’s investments can also fluctuate.

Fixed income securities involve risks such as interest-rate and credit risk. When interest rates rise, bond values fall and vice-versa. Credit risk is the possibility that the bond issuer will not be able to honour debt obligations such as principal and/or interest payments. Investments in foreign markets involve risks related to currency fluctuations, illiquidity and volatility. Asset allocation strategies do not assure profit and do not protect against losses.

Disclaimer

Investment involves risk. The investments discussed in this document may not be suitable for all investors. Investors should make their own investment decisions based on their objectives and financial means and, if in doubt, should seek advice from an investment advisor.

Past performance of the Fund does not guarantee future performance. The value of investments and their respective incomes may fluctuate according to market conditions. Where investment is made in currencies other than the investor’s domestic currency, the value of those investments and any receivables will be impacted by movements in exchange rates.

This document is provided for informational purposes only and does not constitute investment, legal, tax or other advice or any recommendation to buy or sell the securities herein mentioned. Prospective investors should seek appropriate professional advice before making any investment decision.

The price of shares, and the income from them, may decrease or increase; and in certain circumstances a participant’s right to redeem his shares may be suspended.